Delinquent Property Taxes In Philadelphia Pa . in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. a lien is defined as a charge on real or personal property for the satisfaction of debt or duty. Welcome to philadelphia’s sheriff sales on bid4assets. unpaid real property taxes in pennsylvania could lead to an upset tax sale or a judicial tax sale—and the loss of your. The department of revenue files a lien with. Details on the real estate tax sequestration program, in which the city has. To export this table with current filters applied, click the menu icon to the right. home tax foreclosure auctions. Choose “more options” to access the “payments and returns” tab in. prevent sequestration of your property due to unpaid debts. real estate tax delinquencies. log into your philadelphia tax center profile. the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent and tax. Please visit the links below to view lists of.

from www.pewtrusts.org

Welcome to philadelphia’s sheriff sales on bid4assets. Details on the real estate tax sequestration program, in which the city has. real estate tax delinquencies. the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent and tax. prevent sequestration of your property due to unpaid debts. a lien is defined as a charge on real or personal property for the satisfaction of debt or duty. Choose “more options” to access the “payments and returns” tab in. log into your philadelphia tax center profile. The department of revenue files a lien with. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes.

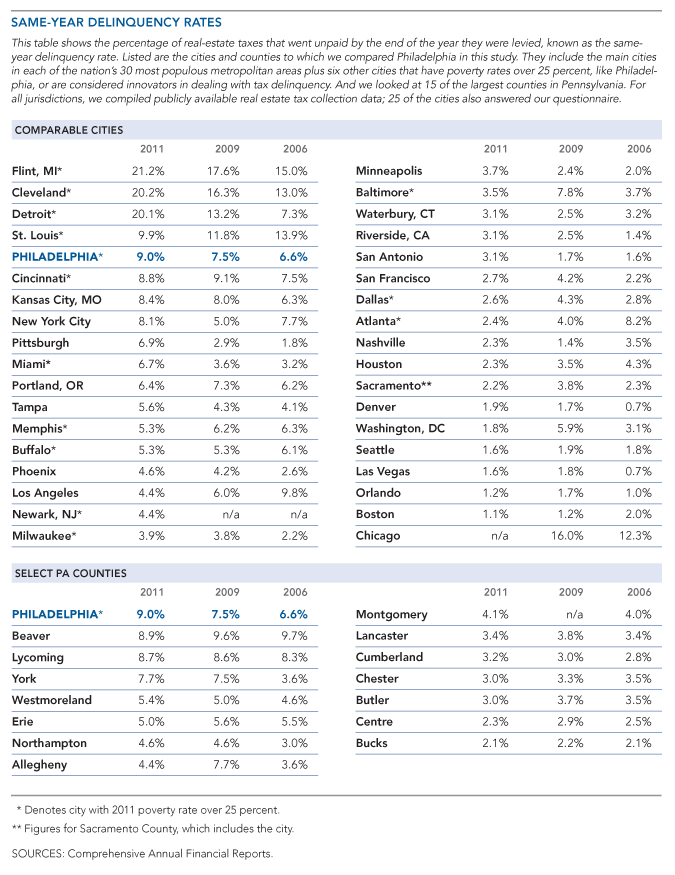

Delinquent Property Tax in Philadelphia Stark Challenges and Realistic Goals The Pew

Delinquent Property Taxes In Philadelphia Pa The department of revenue files a lien with. home tax foreclosure auctions. Please visit the links below to view lists of. unpaid real property taxes in pennsylvania could lead to an upset tax sale or a judicial tax sale—and the loss of your. prevent sequestration of your property due to unpaid debts. Choose “more options” to access the “payments and returns” tab in. Details on the real estate tax sequestration program, in which the city has. a lien is defined as a charge on real or personal property for the satisfaction of debt or duty. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent and tax. real estate tax delinquencies. To export this table with current filters applied, click the menu icon to the right. Welcome to philadelphia’s sheriff sales on bid4assets. The department of revenue files a lien with. log into your philadelphia tax center profile.

From www.pewtrusts.org

Philadelphia Makes Progress on Collecting Delinquent Property Taxes The Pew Charitable Trusts Delinquent Property Taxes In Philadelphia Pa log into your philadelphia tax center profile. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. real estate tax delinquencies. Choose “more options” to access the “payments and returns” tab in. Details on the real estate tax sequestration program, in which the city has. a lien is. Delinquent Property Taxes In Philadelphia Pa.

From diydivapro.com

Understanding the Consequences of Delinquent Property Taxes Delinquent Property Taxes In Philadelphia Pa a lien is defined as a charge on real or personal property for the satisfaction of debt or duty. To export this table with current filters applied, click the menu icon to the right. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. real estate tax delinquencies. Details. Delinquent Property Taxes In Philadelphia Pa.

From www.pewtrusts.org

Philadelphia Makes Progress on Collecting Delinquent Property Taxes The Pew Charitable Trusts Delinquent Property Taxes In Philadelphia Pa To export this table with current filters applied, click the menu icon to the right. the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent and tax. Welcome to philadelphia’s sheriff sales on bid4assets. a lien is defined as a charge on real or personal property for the satisfaction. Delinquent Property Taxes In Philadelphia Pa.

From www.pewtrusts.org

Philadelphia Makes Progress on Collecting Delinquent Property Taxes The Pew Charitable Trusts Delinquent Property Taxes In Philadelphia Pa Details on the real estate tax sequestration program, in which the city has. Welcome to philadelphia’s sheriff sales on bid4assets. Choose “more options” to access the “payments and returns” tab in. Please visit the links below to view lists of. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. . Delinquent Property Taxes In Philadelphia Pa.

From sanjaytaxprozzz.blogspot.com

How To Get Help With Delinquent Property Taxes Delinquent Property Taxes In Philadelphia Pa Choose “more options” to access the “payments and returns” tab in. Welcome to philadelphia’s sheriff sales on bid4assets. the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent and tax. To export this table with current filters applied, click the menu icon to the right. Please visit the links below. Delinquent Property Taxes In Philadelphia Pa.

From slideplayer.com

Improving Tax Compliance ppt download Delinquent Property Taxes In Philadelphia Pa real estate tax delinquencies. Please visit the links below to view lists of. The department of revenue files a lien with. Choose “more options” to access the “payments and returns” tab in. log into your philadelphia tax center profile. Details on the real estate tax sequestration program, in which the city has. home tax foreclosure auctions. . Delinquent Property Taxes In Philadelphia Pa.

From boone.countyclerk.us

Delinquent Property Tax Boone County Clerk's Office Delinquent Property Taxes In Philadelphia Pa Welcome to philadelphia’s sheriff sales on bid4assets. To export this table with current filters applied, click the menu icon to the right. Please visit the links below to view lists of. real estate tax delinquencies. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. the philadelphia land bank. Delinquent Property Taxes In Philadelphia Pa.

From www.pewtrusts.org

Philadelphia Improves on Collecting Delinquent Property Taxes The Pew Charitable Trusts Delinquent Property Taxes In Philadelphia Pa home tax foreclosure auctions. real estate tax delinquencies. To export this table with current filters applied, click the menu icon to the right. Please visit the links below to view lists of. Welcome to philadelphia’s sheriff sales on bid4assets. unpaid real property taxes in pennsylvania could lead to an upset tax sale or a judicial tax sale—and. Delinquent Property Taxes In Philadelphia Pa.

From www.pewtrusts.org

Philadelphia Improves on Collecting Delinquent Property Taxes The Pew Charitable Trusts Delinquent Property Taxes In Philadelphia Pa To export this table with current filters applied, click the menu icon to the right. home tax foreclosure auctions. Choose “more options” to access the “payments and returns” tab in. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. Welcome to philadelphia’s sheriff sales on bid4assets. unpaid real. Delinquent Property Taxes In Philadelphia Pa.

From whyy.org

Philly taking big bite out of unpaid property taxes WHYY Delinquent Property Taxes In Philadelphia Pa Welcome to philadelphia’s sheriff sales on bid4assets. a lien is defined as a charge on real or personal property for the satisfaction of debt or duty. Please visit the links below to view lists of. To export this table with current filters applied, click the menu icon to the right. The department of revenue files a lien with. Choose. Delinquent Property Taxes In Philadelphia Pa.

From www.pewtrusts.org

Delinquent Property Tax in Philadelphia Stark Challenges and Realistic Goals The Pew Delinquent Property Taxes In Philadelphia Pa To export this table with current filters applied, click the menu icon to the right. Choose “more options” to access the “payments and returns” tab in. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. prevent sequestration of your property due to unpaid debts. Please visit the links below. Delinquent Property Taxes In Philadelphia Pa.

From retipster.com

Everything You Need To Know About Getting Your County's "Delinquent Tax List" Delinquent Property Taxes In Philadelphia Pa unpaid real property taxes in pennsylvania could lead to an upset tax sale or a judicial tax sale—and the loss of your. Welcome to philadelphia’s sheriff sales on bid4assets. To export this table with current filters applied, click the menu icon to the right. Details on the real estate tax sequestration program, in which the city has. Choose “more. Delinquent Property Taxes In Philadelphia Pa.

From www.pinterest.com

Check out this interactive map showing tax delinquent properties in Philly, also noting which Delinquent Property Taxes In Philadelphia Pa Details on the real estate tax sequestration program, in which the city has. real estate tax delinquencies. prevent sequestration of your property due to unpaid debts. Please visit the links below to view lists of. unpaid real property taxes in pennsylvania could lead to an upset tax sale or a judicial tax sale—and the loss of your.. Delinquent Property Taxes In Philadelphia Pa.

From www.youtube.com

How to find Tax Delinquent Real Estate Deals YouTube Delinquent Property Taxes In Philadelphia Pa Details on the real estate tax sequestration program, in which the city has. prevent sequestration of your property due to unpaid debts. To export this table with current filters applied, click the menu icon to the right. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. real estate. Delinquent Property Taxes In Philadelphia Pa.

From tarentumboro.com

Delinquent Property Tax List Published • Tarentum Borough Delinquent Property Taxes In Philadelphia Pa Please visit the links below to view lists of. unpaid real property taxes in pennsylvania could lead to an upset tax sale or a judicial tax sale—and the loss of your. The department of revenue files a lien with. the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent. Delinquent Property Taxes In Philadelphia Pa.

From www.pewtrusts.org

Philadelphia Makes Progress on Collecting Delinquent Property Taxes The Pew Charitable Trusts Delinquent Property Taxes In Philadelphia Pa Welcome to philadelphia’s sheriff sales on bid4assets. Please visit the links below to view lists of. Details on the real estate tax sequestration program, in which the city has. log into your philadelphia tax center profile. home tax foreclosure auctions. a lien is defined as a charge on real or personal property for the satisfaction of debt. Delinquent Property Taxes In Philadelphia Pa.

From retipster.com

Everything You Need To Know About Getting Your County's "Delinquent Tax List" REtipster Delinquent Property Taxes In Philadelphia Pa the philadelphia land bank will be bidding on certain properties that have been identified on the sheriff tax delinquent and tax. To export this table with current filters applied, click the menu icon to the right. home tax foreclosure auctions. Choose “more options” to access the “payments and returns” tab in. The department of revenue files a lien. Delinquent Property Taxes In Philadelphia Pa.

From whyy.org

Mapping tax delinquent properties in Philadelphia WHYY Delinquent Property Taxes In Philadelphia Pa Welcome to philadelphia’s sheriff sales on bid4assets. in philadelphia, a property is considered tax delinquent nine months after the city’s march 31 payment deadline passes. a lien is defined as a charge on real or personal property for the satisfaction of debt or duty. log into your philadelphia tax center profile. Details on the real estate tax. Delinquent Property Taxes In Philadelphia Pa.